From saturated domains to untapped opportunities — the data every founder needs to see before choosing their market.

I analyzed every single company in YC’s 2025 cohorts and found something shocking: the biggest opportunities aren’t where everyone’s looking.

Most AI founders are building in markets with 90+ competitors. But I discovered entire billion-dollar industries with fewer than 3 AI startups total.

With this analysis, I wanted to understand:

- what problems people are solving,

- what type of AI agents are being built,

- which industries are the most common and get easily accepted in YC,

- which industries are oversaturated,

- gaps(opportunities) are worth exploring,

- latest tech people are developing,

- positioning strategies used by winners,

- how to validate idea looking at the selected companies.

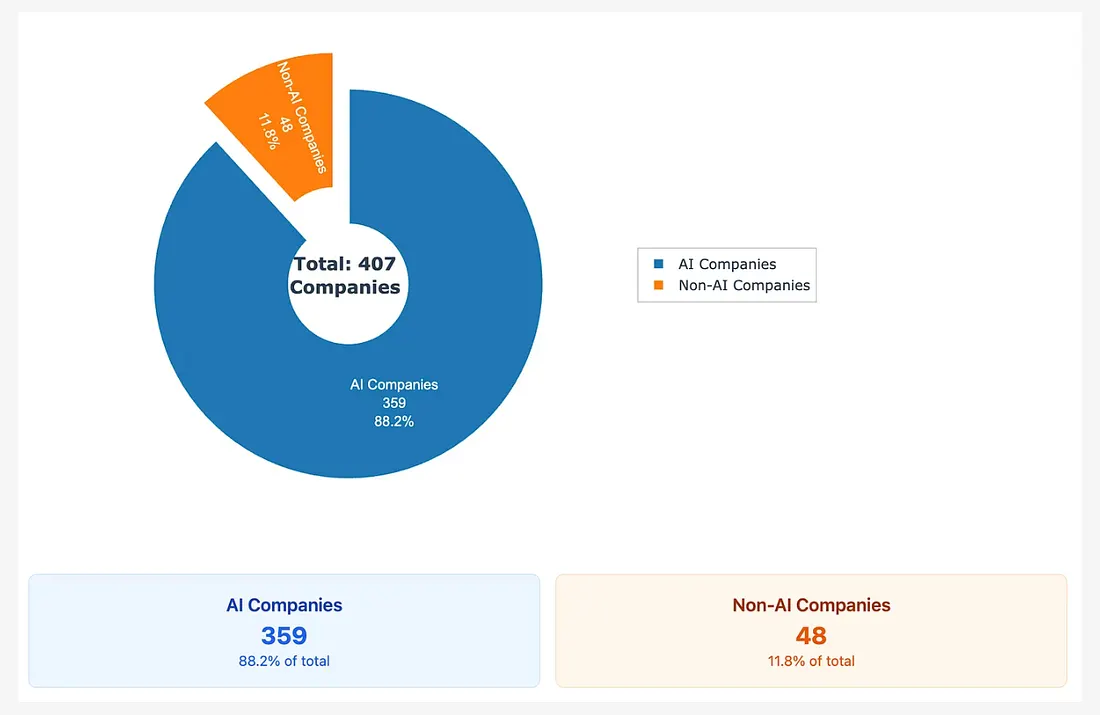

While 88% of founders are building AI companies, most are fighting brutal competition in oversaturated markets.

Developer tools alone attracted 94 companies — that’s one new competitor every 4 days.

But here’s what’s shocking: the biggest opportunities aren’t where the crowds are.

We found entire billion-dollar industries with almost zero AI competition.

- Government tech has 600+ billion in spending but only 1 YC company.

- Insurance processes 1.4 trillion annually with virtually no AI startups.

- Construction wastes 2 trillion yearly on delays that AI could easily prevent.

Companies succeeding in crowded markets aren’t winning with better algorithms. They’re winning by understanding one industry deeply instead of trying to solve everything for everyone.

This complete analysis shows you exactly which markets are oversaturated, which are wide open, and how 16 companies positioned themselves to dominate despite fierce competition.

If you’re building an AI company, you’ll find this analysis super insightful.

Comments

Join the conversation with thoughtful feedback.

Log in to comment

Sign in to share your insights, ask questions, and connect with other readers.