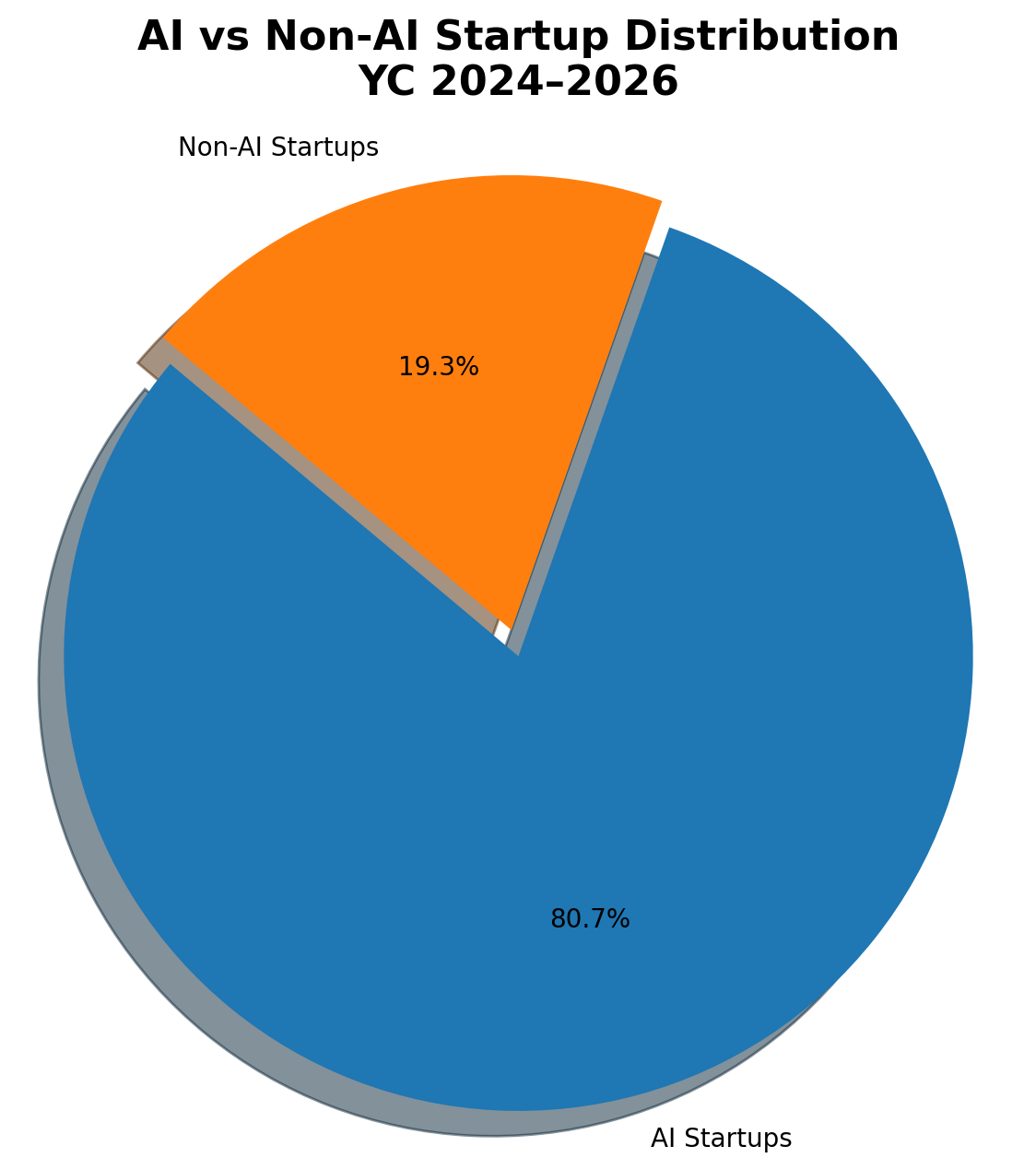

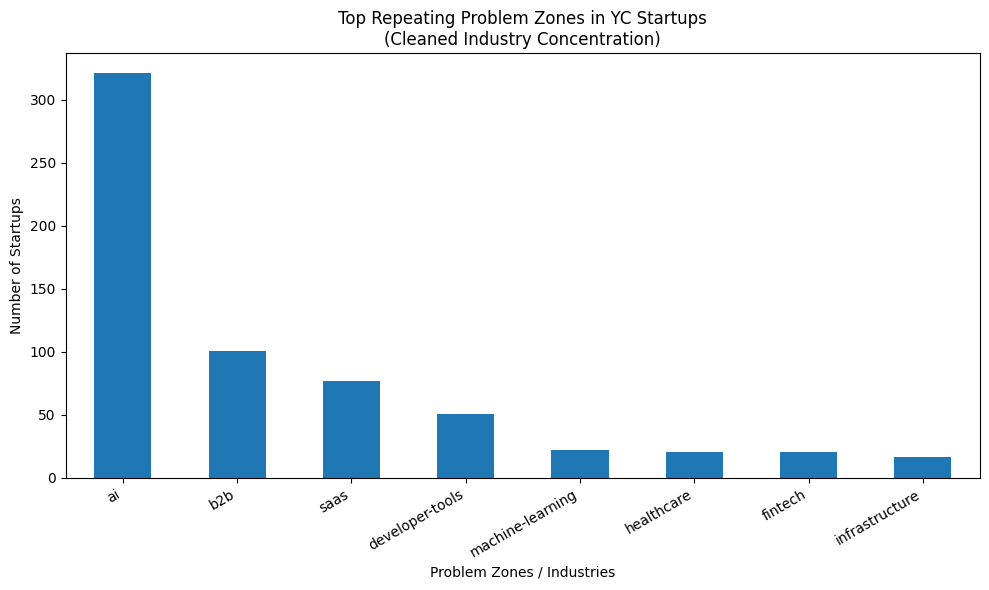

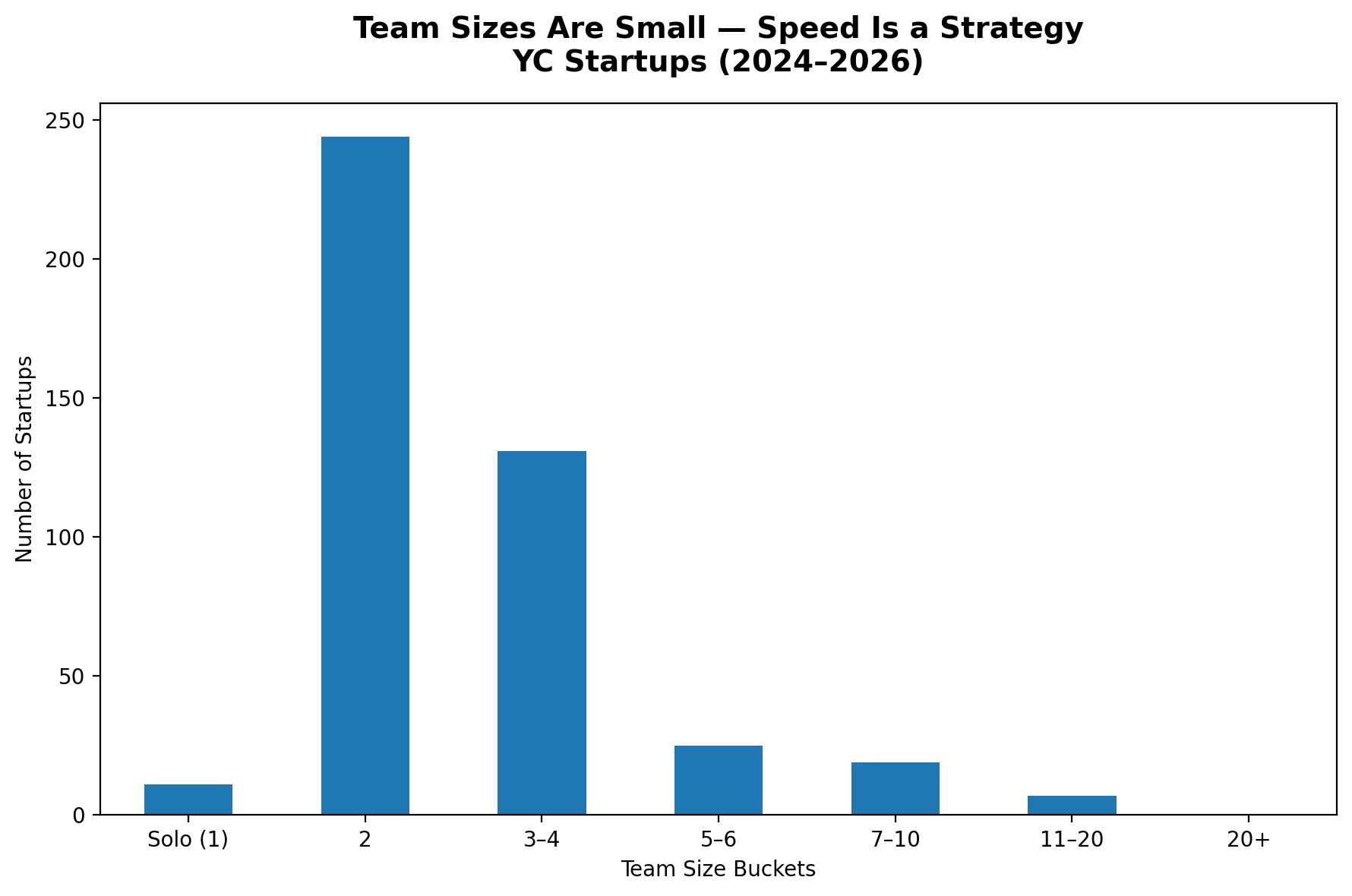

We analyzed every company across YC’s 2024, YC’s 2025, and YC’s 2026 cohorts. Using rigorous data analysis, we decoded the hidden patterns of how the game is actually played and uncovered a truth, the biggest opportunities are not where everyone is looking.

Most of these founders are very busy 'building.' They are coding until their eyes bleed, they are tweaking UIs, they are shouting into the void of social media. They feel productive because they are creating activity. But in the mechanics of the universe, activity without alignment is just friction. It is just noise.

The Decoded signal represent the one thing that makes a company inevitable is when the technology becomes like your own heartbeat. You do not have to 'manage' your heart, do you? You do not need a dashboard to tell your lungs to breathe. It happens.

I found that the winners in YC's dataset have moved from 'Software as a Service' to 'Software as a Living Organism.'"

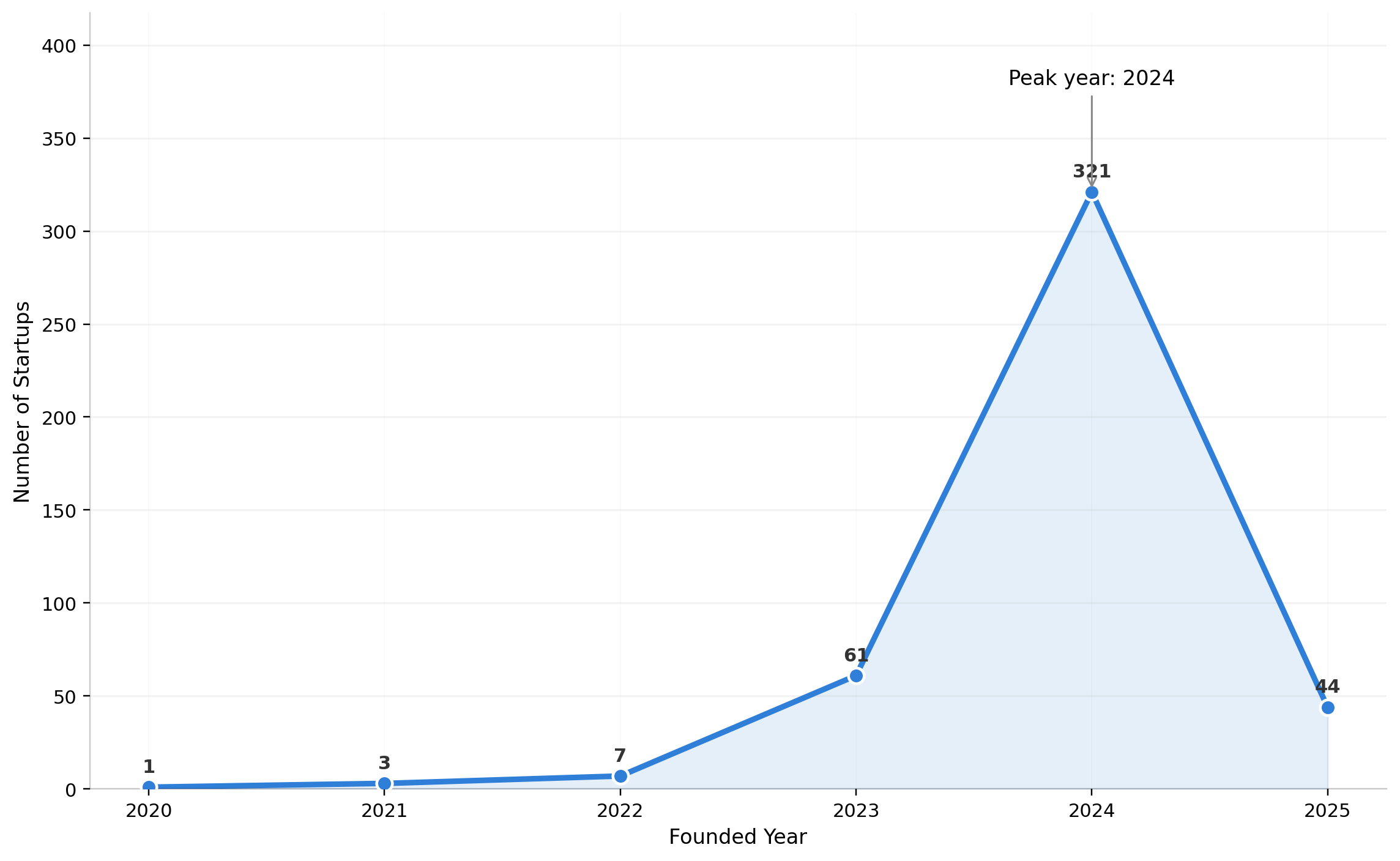

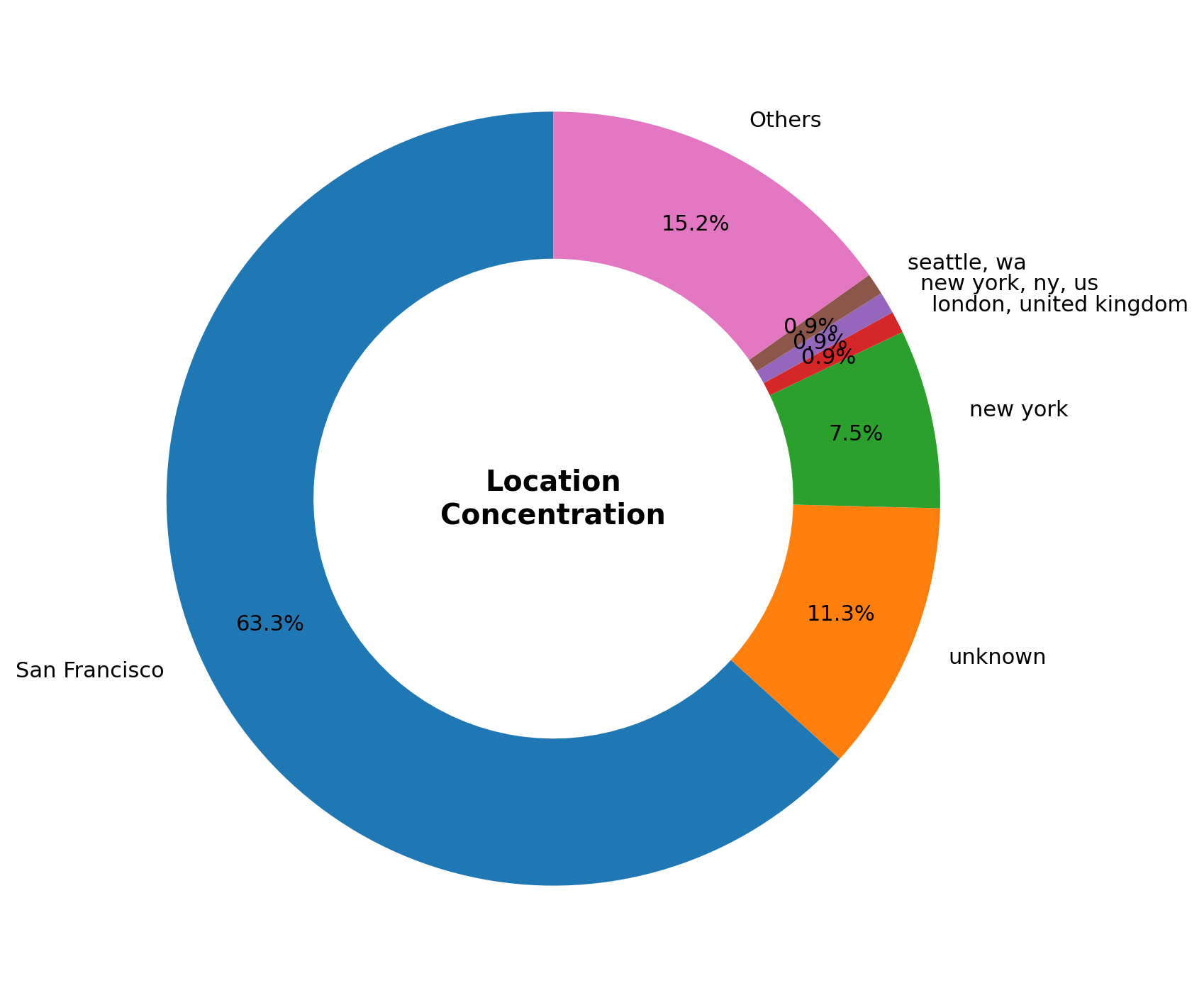

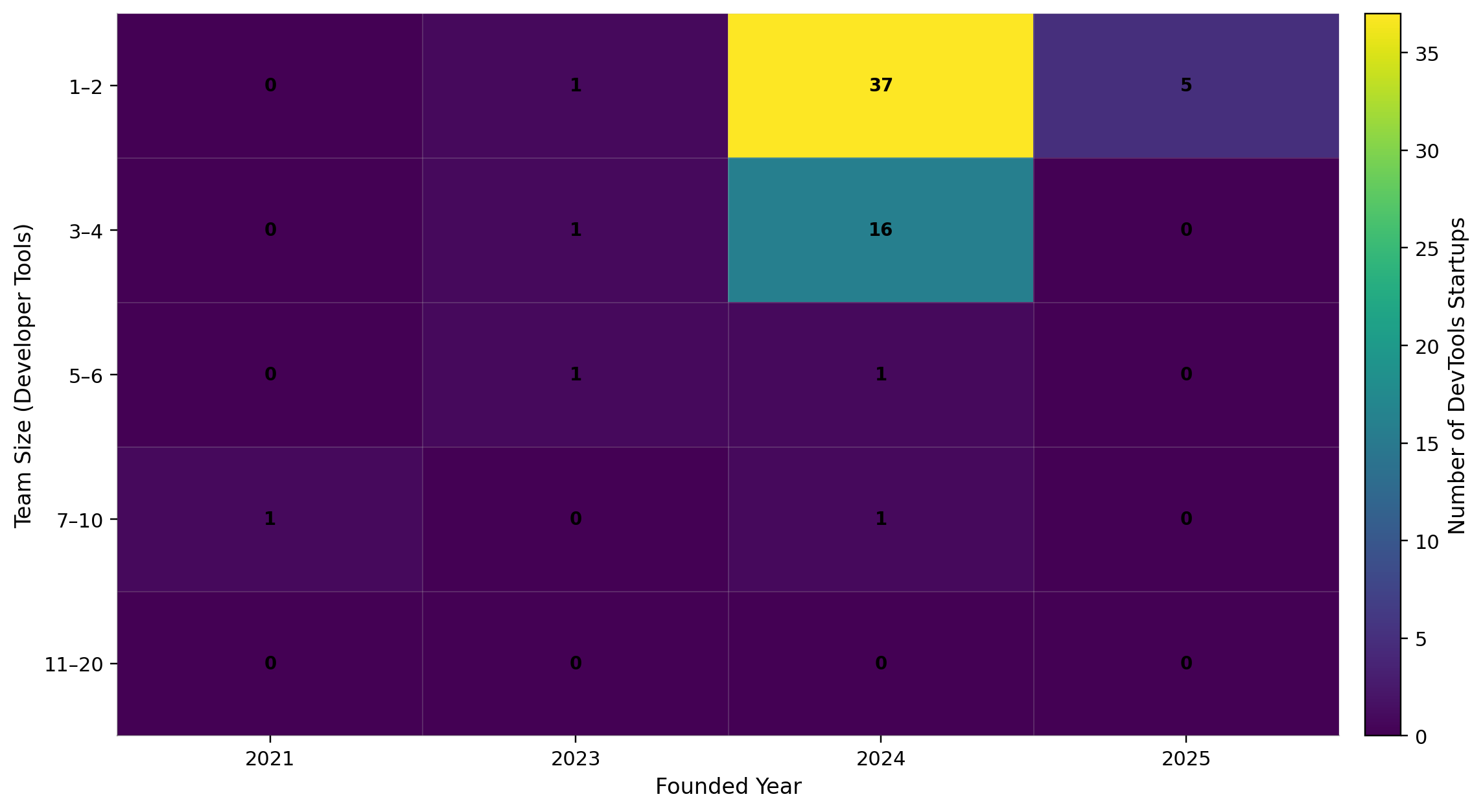

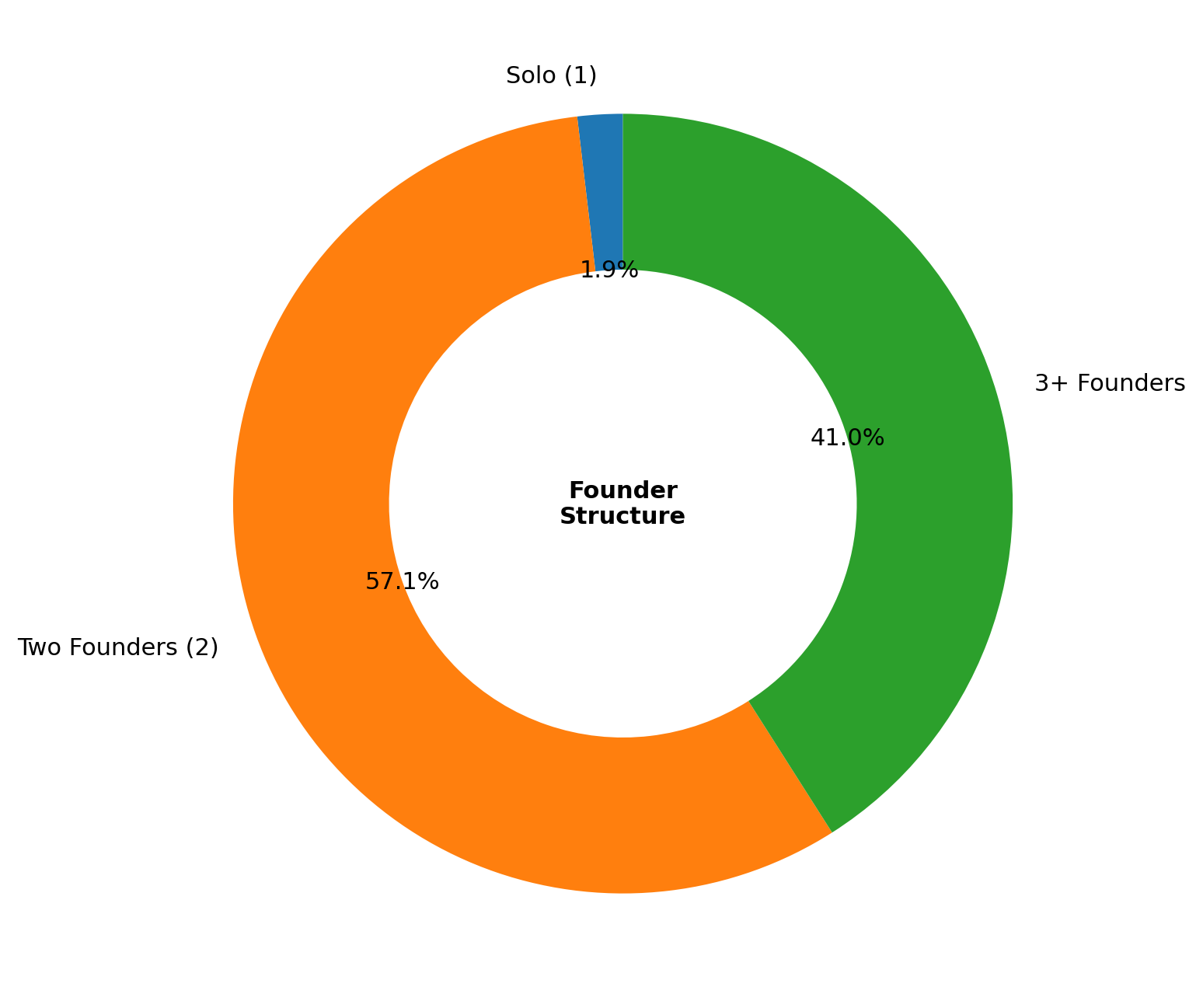

When Everyone Has an Idea, Clarity Becomes the Advantage. Let’s dive into Y Combinator’s database and look at what the data actually reveals.

Comments

Join the conversation with thoughtful feedback.

Log in to comment

Sign in to share your insights, ask questions, and connect with other readers.